Altcoins (alternative coins) is a term used to describe all cryptocurrencies other than Bitcoin. Their name comes from the fact that they’re alternatives to Bitcoin and traditional fiat money.

The first altcoins launched in 2011, and, by now, there are thousands of them. Early altcoins aimed at improving aspects of Bitcoin such as transaction speeds or energy efficiency. More recent altcoins serve a variety of purposes depending on the goals of the developers.

Since altcoins are such a big part of the market, every crypto investor should understand how they work. Keep reading to learn about what altcoins are used for, their pros and cons, and much more.

What are the types of altcoins?

There are several different types of altcoins, including stablecoins, mining-based coins, staking-based coins, and governance tokens. The type of altcoin depends on how it works and what its purpose is. Here are the main types of cryptocurrencies you’ll find when researching altcoins.

Stablecoins

Stablecoins are cryptocurrencies designed to follow the price of another asset. Most of the biggest stablecoins are pegged to the U.S. dollar and attempt to mimic its value. If the price fluctuates, the issuer of the coin will take steps to correct it.

Because stablecoins are intended to maintain the same value, they’re normally not chosen as a cryptocurrency investment. Instead, people use stablecoins for savings or to send money. It’s also possible to earn interest on stablecoins by lending them out or through certain savings protocols.

Mining-based

This type of cryptocurrency use a process called mining to verify transactions and add more coins to the supply. Miners use devices to solve mathematical equations. Typically, the first miner to solve the equation gets to verify a block of transactions. In return, miners who verify blocks receive crypto rewards.

Since Bitcoin is a mining-based cryptocurrency, mining was the first method used to process crypto transactions. One disadvantage of mining is that it requires significant energy.

Staking-based

These cryptocurrencies use a process called staking to verify transactions and add more coins to the supply. Holders of a staking-based cryptocurrency can choose to stake their coins, meaning they’re pledging those coins to be used for transaction processing. The cryptocurrency’s blockchain protocol chooses a participant to verify a block of transactions. In return, participants receive crypto rewards.

An early altcoin called Peercoin (CRYPTO:PPC) was the first to introduce the concept of staking. Although Peercoin hasn’t become a household name, staking has become popular because it’s more energy-efficient than mining.

Governance

Governance tokens are cryptocurrencies that give holders voting rights to help shape the future of the project. In most cases, these tokens allow you to create and vote on proposals related to the cryptocurrency. This helps make the cryptocurrency a decentralized project since all the holders have a say, and decisions aren’t made by one central authority.

Pros and cons of altcoins

Here are the pros and cons of altcoins:

| PROS | CONS |

|---|---|

| Improve on aspects of Bitcoin. | Don’t have Bitcoin’s first mover advantage or market share. |

| Offer high potential rewards. | Significant risk, as many altcoins are scams or end up failing. |

| Large selection of altcoins, all with their own unique purposes and competitive advantages. | Many altcoins are hard to buy because they’re only available on certain altcoin exchanges. |

Altcoins vs. Bitcoin

There are a few things that separate altcoins and Bitcoin:

- Bitcoin is older. It launched in 2009, whereas the first altcoins came out in 2011, and new altcoins are released regularly.

- With the exception of stablecoins, altcoins tend to offer a higher risk and reward as a cryptocurrency investment. Although Bitcoin is volatile, it’s the market leader and has already gained substantial value. Altcoins have more room to grow, but they also have a higher chance of failure.

- Altcoins are more advanced. Since they came out after Bitcoin, they’ve improved on its technology. In terms of transaction speeds and costs, many altcoins are far superior to Bitcoin.

Examples of altcoins

The crypto market includes thousands of altcoins. Here’s an early example and a couple of the top altcoins:

- Namecoin Released in April 2011, Namecoin is the first notable altcoin. It’s similar to Bitcoin since it’s based on Bitcoin’s code and has the same maximum supply of 21 million coins. Namecoin is known for introducing .bit web domains, which offer anonymity and resistance to censorship.

- Ethereum Released in July 2015, Ethereum was the first cryptocurrency to offer a programmable blockchain for developers to use. It quickly became the second-largest cryptocurrency behind Bitcoin.

- USD Coin Released in September 2018, USD Coin is a stablecoin pegged to the U.S. dollar. It’s under governance by Centre, a consortium that includes Coinbase Global, Inc.

Should you consider investing in altcoins?

You should consider investing in altcoins if you’re going to make crypto part of your portfolio and you have time to spend researching them. Some altcoins are ambitious projects that offer more use cases than Bitcoin, which is primarily used as a store of value. Since altcoins aren’t as well-known, they could see larger price increases if they catch on.

There are notable downsides to buying altcoins. Because of the sheer number of them, it’s challenging to pick out the best altcoins to invest in. Altcoins present a greater risk, and many of the smaller altcoins are dubious investments or scams.

To sum it up, altcoins are worth checking out for hands-on cryptocurrency investors willing to do their homework. If you’re looking for a lower-risk or less time-intensive investment, cryptocurrency stocks are a better way to go. Remember that taking on too much risk isn’t recommended, so even if you decide to buy altcoins, they should only make up a small part of your portfolio.

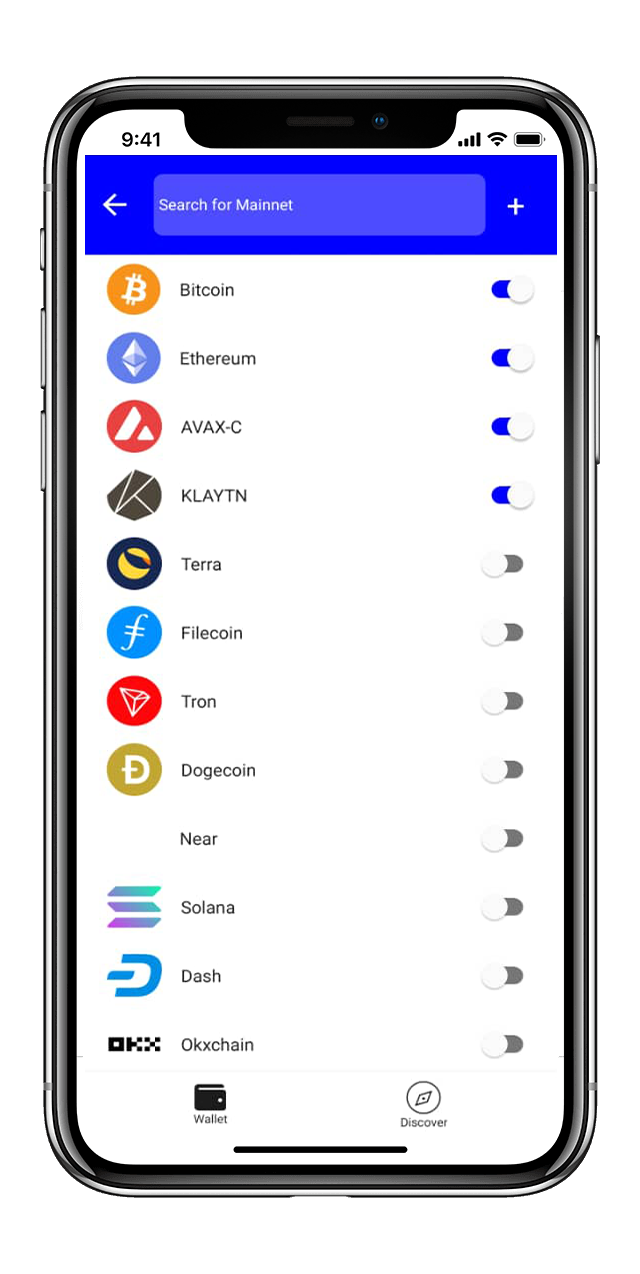

The safest way to buy and keep Bitcoin is NOT on an Exchange, but instead on a non custodial wallet. What is that? That is one that no one else has access to, that only you do. An example of this is CoinSafe.

Get your FREE CoinSafe Wallet here

Read more articles HERE

Be Social on Instagram – Facebook

This article and the other articles, posts and pages on this site are for informational purposes only. This is not advice nor financial advice and we strongly encourage everyone to do their own research and make their own choices as to what actions to take.